Automotive enthusiasts and keen investors alike often ponder the correlation between the Dow Jones Industrial Average (DJIA) and the performance of automotive stocks in the market. In this analytical exploration, we explore into the intricate dynamics that dictate how these two entities influence and reflect each other within finance. By scrutinizing historical data, market trends, and economic indicators, we aim to unveil the complex interplay between these key indicators of economic health and market performance.

Historical Context

The Evolution of the Dow Jones Industrial Average

While investigating the relationship between the Dow Jones Industrial Average and automotive stocks, one must research into the historical context of the Dow. Initially comprised of just 12 industrial stocks, the DJIA has evolved over time to become a key indicator of the health of the stock market. Founded in 1896 by Charles Dow and Edward Jones, this index has grown to include 30 prominent companies across various sectors, reflecting the changing landscape of the American economy.

The Rise of the Automotive Industry

Evolution of the automotive industry played a significant role in the history and performance of the Dow Jones Industrial Average. As one of the leading sectors represented in the index, automotive stocks have had a noticeable impact on its movements. The rise of iconic American car manufacturers like Ford and General Motors, alongside the emergence of innovative electric vehicle companies, has shaped the automotive industry’s influence on the stock market.

Rise of the Automotive Industry, especially notable in the 20th and 21st centuries, marked a period of technological advancements, market expansion, and fierce competition among automakers. The development of new models, the introduction of revolutionary technologies, and shifts in consumer preferences have all contributed to the dynamic nature of automotive stocks within the financial market.

Correlation Analysis

Examining the Relationship Between DJIA and Automotive Stocks

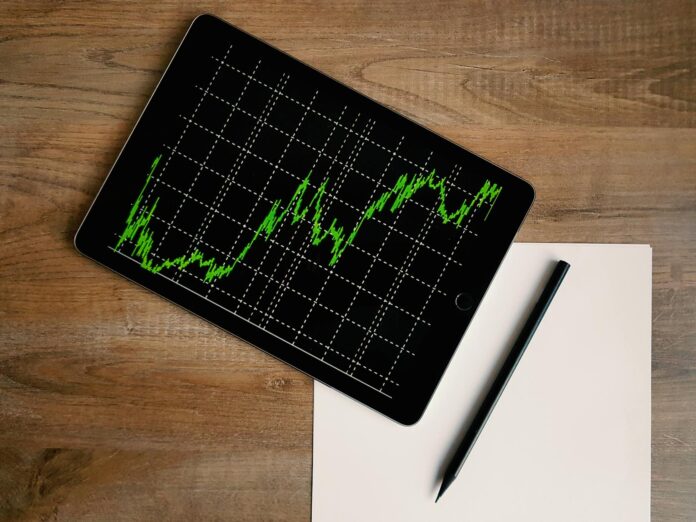

Little can provide as much insight into the financial markets as a correlation analysis. When considering understanding the dynamics between the Dow Jones Industrial Average (DJIA) and automotive stocks, examining their relationship through correlation analysis can reveal valuable information. By looking at historical data and calculating correlations, we can uncover how these two sectors interact and influence each other.

Identifying Key Trends and Patterns

Between the DJIA and automotive stocks, identifying key trends and patterns is crucial for making informed investment decisions. Patterns such as seasonality, cyclical movements, or reactions to economic indicators can offer valuable insights into the future performance of these assets. By analyzing historical data and identifying recurring patterns, investors can better anticipate market movements and adjust their strategies accordingly.

With the help of advanced analytical tools and techniques, investors can examine deeper into the relationship between the DJIA and automotive stocks. Identifying key trends and patterns can provide a competitive edge in navigating the complexities of the financial markets and optimizing investment portfolios.

Market Forces

How Economic Indicators Impact Automotive Stocks

Stocks in the automotive industry are significantly impacted by economic indicators. Factors such as consumer confidence, interest rates, and GDP growth play a crucial role in determining the performance of automotive stocks. When these economic indicators are favorable, such as low-interest rates stimulating car purchases or strong GDP growth leading to increased consumer spending, automotive stocks tend to perform well. Conversely, negative economic indicators can lead to a decline in automotive stock prices.

The Influence of Global Events on the DJIA

Economic events on a global scale can have a substantial impact on the performance of the Dow Jones Industrial Average. Global trade tensions, geopolitical conflicts, and natural disasters are just a few examples of events that can cause fluctuations in the DJIA. When such events occur, investors often react by buying or selling stocks, leading to volatility in the market. Understanding how these global events influence the DJIA is crucial for investors looking to navigate the complexities of the stock market.

To further illustrate, trade negotiations between major economies like the United States and China can cause fluctuations in the DJIA. If tariffs are imposed or trade talks break down, it can lead to uncertainty in the market, affecting not only the performance of the DJIA but also impacting automotive stocks and other sectors dependent on global trade.

Industry Insights

The Role of Automotive Giants in the DJIA

Not surprisingly, automotive giants play a significant role in the Dow Jones Industrial Average (DJIA). Companies like General Motors, Ford, and Tesla have a considerable impact on the index due to their market capitalization and influence in the automotive industry. These companies’ performance can sway the direction of the DJIA, especially during times of economic uncertainty or significant industry shifts.

The Impact of Technological Advancements on Automotive Stocks

Advancements in technology have revolutionized the automotive industry, leading to a significant impact on automotive stocks. Companies that innovate in electric vehicles, autonomous driving technology, and connectivity solutions have seen substantial growth in their stock prices. On the other hand, those slow to adapt to these changes have faced challenges in keeping up with market trends and investor expectations.

With electric vehicles gaining popularity and becoming more mainstream, investors are closely monitoring how automotive companies navigate this shift. Companies that successfully integrate these technological advancements into their products and services are likely to see their stocks outperform those that lag behind in innovation.

Statistical Analysis

Regression Analysis of DJIA and Automotive Stock Performance

Your analysis of the relationship between the Dow Jones Industrial Average (DJIA) and automotive stocks involved a regression model to understand how changes in the DJIA may impact the performance of automotive stocks. By running a regression analysis, you can quantify the relationship between these variables and determine the extent to which automotive stocks are influenced by movements in the broader market represented by the DJIA.

A Closer Look at Volatility and Risk

Any examination of the relationship between the Dow Jones Industrial Average and automotive stocks should also include an analysis of volatility and risk. Understanding the level of volatility in both the DJIA and automotive stocks is crucial for investors looking to assess the potential risks and rewards associated with investing in these assets. By examining historical volatility and risk metrics, such as standard deviation and beta, one can gain insight into how these stocks may behave in different market conditions.

Stock market volatility can significantly impact the performance of automotive stocks, making it crucial to analyze and understand the risk factors associated with these investments. By delving deeper into the volatility and risk profile of automotive stocks in relation to the DJIA, investors can make more informed decisions about their investment portfolios and risk management strategies.

Investment Strategies

Diversification and Risk Management

To effectively manage risk and optimize returns, investors often turn to diversification as a key strategy when considering investing in the stock market. By spreading investments across various sectors, including the automotive industry, investors can reduce the impact of market volatility on their portfolio. Diversifying among automotive stocks, such as Ford, General Motors, and Tesla, can help balance out potential market fluctuations specific to any single company within the sector.

Opportunities for Growth in the Automotive Sector

To capitalize on growth in the automotive sector, investors can strategically allocate a portion of their portfolios to automotive stocks. With advancements in electric vehicles, autonomous driving technology, and sustainable practices, there are opportunities for significant growth within the industry. Companies like Tesla, with its innovative approach to electric vehicles, and traditional automakers adapting to changing consumer demands, present opportunities for investors seeking exposure to the evolving automotive landscape.

Management of the automotive sector is critical for investors looking to capitalize on growth opportunities within the industry. It is important to stay informed about market trends, technological advancements, and regulatory changes that may impact automotive stocks. By conducting thorough research and staying abreast of industry developments, investors can make informed decisions when selecting and managing their investments in automotive companies.

Final Words

Following this exploration of the relationship between the Dow Jones Industrial Average and automotive stocks, it is clear that there is a significant correlation between the two. Investors and analysts can use this information to make informed decisions when considering investments in automotive companies based on the overall performance of the market.

Understanding how the Dow Jones Industrial Average can impact the automotive industry provides valuable insights into how external factors can influence stock prices. By keeping a close eye on market trends and economic indicators, investors can better navigate the complexities of the stock market and potentially improve their investment strategies in the automotive sector.

FAQ

Q: What is the relationship between the Dow Jones Industrial Average and Automotive Stocks?

A: The Dow Jones Industrial Average (DJIA) is an index that tracks the performance of 30 large, publicly-owned companies trading on the New York Stock Exchange (NYSE) and the NASDAQ. Automotive stocks, on the other hand, are stocks of companies involved in the manufacturing, marketing, and sales of automobiles. The relationship between the DJIA and automotive stocks can be influenced by various factors such as consumer demand for vehicles, oil prices, interest rates, and overall economic conditions.

Q: How does the performance of Automotive Stocks impact the Dow Jones Industrial Average?

A: The performance of automotive stocks can have a significant impact on the Dow Jones Industrial Average. Since automotive companies are integral parts of the economy and stock market, any major developments, such as strong sales figures, new product launches, or regulatory changes, can lead to fluctuations in their stock prices, which in turn can affect the overall performance of the DJIA. Investors and analysts often closely monitor automotive stocks as they can provide valuable insights into the health of the economy.

Q: What are some key factors to consider when exploring the relationship between the Dow Jones Industrial Average and Automotive Stocks?

A: When exploring the relationship between the Dow Jones Industrial Average and Automotive Stocks, it is important to consider factors such as consumer trends, technological advancements in the automotive industry, government policies related to transportation and environment, global economic conditions, and competitive dynamics among automotive companies. Additionally, understanding the historical performance of automotive stocks in relation to the DJIA and conducting thorough research and analysis can provide valuable insights for investors and financial professionals.